Shares of Trump Media surged over 9% on Wednesday following the company's announcement that it was calling on House Republican committee leaders to investigate potential “unlawful manipulation” of its stock.

The surge in stock price also coincided with the passing of a deadline for President Trump, who holds the majority ownership in the company, to become eligible for an additional 36 million “earnout” shares. As of 3:25 p.m. ET, the value of this stake was estimated to be more than $1.3 billion based on the share price.

The exact reason behind the sudden rise of Trump Media remained unclear, as the company started the trading day with a nearly 5% decline before reversing course and turning positive later in the morning on Wednesday.

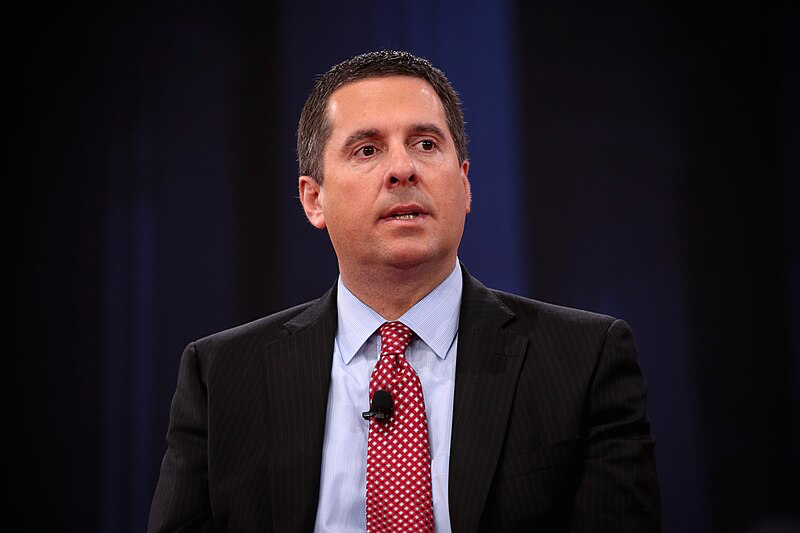

In a letter sent on Tuesday, the CEO of the company, Devin Nunes, urged GOP chairs to investigate the “anomalous trading” of Trump Media's stock to determine the extent of alleged manipulation and whether any laws, including RICO statutes and tax evasion laws, were violated. This request reinforces Nunes' assertion that Trump Media, traded under the ticker DJT, is the victim of “naked” short selling, a practice involving selling a company's shares without first borrowing them for that purpose. Nunes emphasized that the investigation is crucial to safeguard the interests of the company's shareholders and to ensure that any individuals engaged in illegal activities are held accountable for their actions.

Nunes' letter also intensifies the conflict with Citadel Securities, the capital markets firm established by GOP megadonor Ken Griffin. In an April 18 letter to Nasdaq CEO Adena Friedman, Nunes highlighted that DJT was listed on Nasdaq's “Reg SHO threshold list,” indicating potential unlawful trading activity. He reiterated references to Citadel Securities in the recent letter sent to Congress.

Nunes informed Friedman that over 60% of DJT shares had been traded by just four market participants, including Citadel Securities.