The Official Bitcoin Partner of Badlands Media

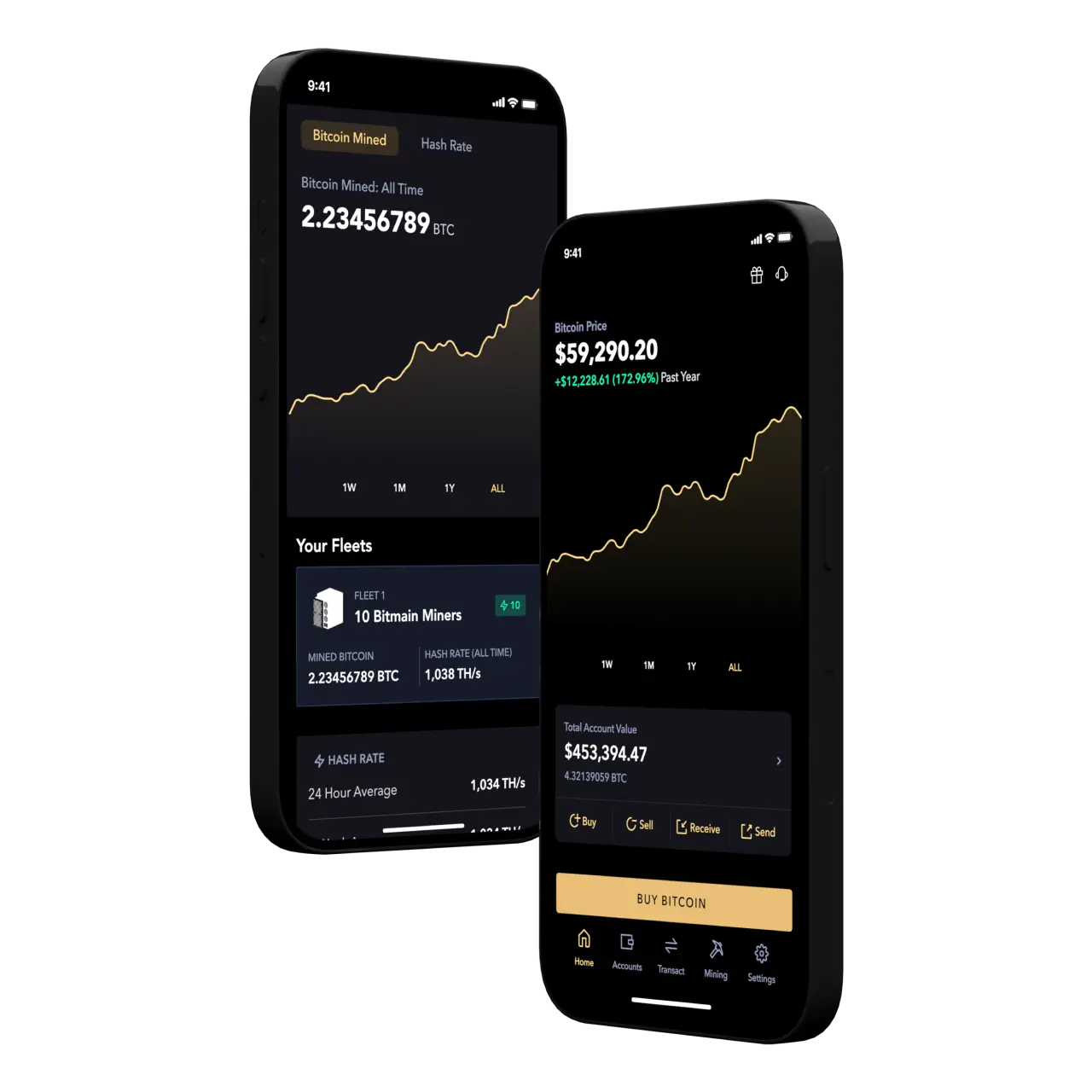

Invest with Confidence

Licensed and regulated in the US

On-demand live support

Zero fees on recurring orders.

“I've selected River as my primary referral exchange for clients based on several factors. These include ownership of their own technology stack (eliminating third-party custodians), their provision of the lightning liquidity pool for El Salvador, and boasting the finest onboarding team in the Bitcoin realm. Opting for a company dedicated solely to supporting Bitcoin's ecosystem, rather than delving into alt-coins, speaks volumes about their integrity and steadfast commitment.”

-GMONEY

Learn More About Bitcoin

What is Bitcoin?

Bitcoin is a digital money. Unlike fiat currencies such as the U.S. dollar, Bitcoin is not controlled by any central authority. Instead, Bitcoin is regulated by a set of rules. This makes Bitcoin decentralized. Nobody independently owns or controls Bitcoin, so everyone can participate in the network.

Bitcoin’s creator, Satoshi Nakamoto, explained Bitcoin’s purpose in a whitepaper:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

What Are Public and Private Keys?

In the context of Bitcoin, a private key is what proves ownership of the funds corresponding to a given address. The private key is used to create signatures which are required to spend bitcoin.

Private Key and Public Key

Bitcoin uses public key cryptography to create a key pair—a corresponding public and private key—that controls ownership of bitcoin. The public key is used to receive bitcoin, while the private key allows a user to sign transactions by creating a digital signature and thus spend the bitcoin. When a user presents a public key and signature, anyone on the Bitcoin network can verify and accept a transaction as valid, confirming that the user spending the bitcoin is the true owner of the funds.

How Is a Private Key Generated?

Private keys are usually generated by a user’s Bitcoin wallet. However, the user almost never has to see or directly interact with their private keys as their wallet handles all of the complex math behind the scenes.

Bitcoin wallets use an industry standard to derive private keys. First, the wallet uses a secure random number generator to generate a seed, which can then be used to derive as many keys as are needed by the user. This setup allows the wallet to backup only one seed and not each unique private key.

How Private Keys Are Used in a Transaction

We will use a sample transaction to better illustrate the process of how private keys are used in the Bitcoin network.

If Bob wants to send Alice one bitcoin, the transaction would take place as follows.

- Bob opens his wallet and enters Alice’s public key into the recipient field of the wallet.

- The wallet software creates a transaction and signs it using Bob’s private keys. If the digital signature that is generated corresponds to the funds Bob is attempting to send, the transaction will be accepted as valid by the Bitcoin network.

- The funds now can be accessed by whoever owns the private keys that correspond to Alice’s public key. In this case, that is Alice, as she is the only one who holds that private key.

Can Bitcoin Be Banned?

Bitcoin Is Private

One reason governments might ban Bitcoin is its private nature. While Bitcoin is not anonymous, it can enable great privacy if used properly, allowing users to avoid the surveillance of the traditional financial system. This makes it hard for governments to track and surveil their citizens.

Bitcoin Is Censorship-Resistant

Bitcoin transactions are practically impossible to reverse or block, meaning that any individual can send bitcoin to any other individual. Bitcoin is inconvenient for governments when compared to the traditional financial system, where accounts can easily be frozen or emptied.

Bitcoin Threatens Weak National Currencies

Governments may ban Bitcoin because it threatens the value of their fiat currencies. Governments maintain significant control over large populations and the economy by forcing their citizens to use a currency that only they can control. Their ability to spend and service debts is also dependent on their ability to print new money. When a superior currency like Bitcoin exists, it hinders that ability.

Can a Government Successfully Ban Bitcoin?

So far, no government has successfully eradicated or even reduced Bitcoin usage in their country. However, some Bitcoin critics and even some supporters claim more sophisticated and motivated attempts at a Bitcoin ban may occur in the future.

There exist two distinct possibilities for a Bitcoin ban. A government may attempt to ban the exchange of bitcoin, while accepting that they cannot take down the network itself. Alternatively, a government, or coalition of governments, may attempt to destroy the entire network and stop all Bitcoin activity.

Banning the Exchange of Bitcoin

If a single government banned Bitcoin, their first target would be centralized Bitcoin institutions, such as lending platforms, brokerages, and exchanges. These institutions usually comply with financial services laws and would be vulnerable to legal action because of their public presence and reliance on the traditional financial system. A successful shutdown of centralized institutions would choke access to Bitcoin for a majority of users, and could potentially crash the price of bitcoin, depending on the country’s share of the Bitcoin economy.

The results of a ban depend on the determination of users. If users submit and give up on Bitcoin, the ban could be widely successful. As we saw in Nigeria however, that is not always the case. If users turn to decentralized, peer-to-peer platforms to obtain and use bitcoin, the Bitcoin economy will continue to flourish.

Banning the Bitcoin Network

Shutting down the entire Bitcoin network is a significantly harder task for governments. Bitcoin is a global network that uses the internet to relay transactions. So long as an individual can establish a connection with another Bitcoin node, they can broadcast a transaction and continue using Bitcoin. Bitcoin nodes are distributed across the globe, so even if a government eliminated all nodes in their own country, they would have to prevent their citizens from connecting with nodes in other jurisdictions as well, a near-impossible feat.

A Bitcoin ban will likely resemble America’s prohibition of alcohol in the 1920s, which drove alcohol use underground but did not reduce its usage. The benefits of using Bitcoin will incentivize widespread use even under discouraging legal conditions.

It is easy for detractors to make sweeping statements about how Bitcoin will be banned by governments, but in reality this is a nuanced discussion. Banning software is incredibly difficult and would encourage developers to continue to make Bitcoin activity invisible to onlookers. As time progresses, more and more people within governments will own bitcoin themselves, or have family members who do.

Their government banning Bitcoin is just one of many concerns users have when deciding to buy Bitcoin or not. Fortunately, there are answers to these concerns.

I don't know what I'm doing. Is there help?

River offers 4 different types of support:

1. Phone

2. Online chat

3. Email support

4. Online help center – Includes guides for newbies and advanced users.

River's support hours are:

How Many Satoshis Are in a Bitcoin?

A satoshi is the atomic unit of bitcoin; each bitcoin is divisible into 100,000,000 satoshis, which are often called sats. The satoshi is named in honor of Bitcoin’s founder, Satoshi Nakamoto.

On the Bitcoin blockchain and in its source code, all amounts of bitcoin are denominated in satoshis. These amounts are only converted to bitcoin for familiarity and readability. One satoshi equals 0.00000001 bitcoin.

This makes buying Bitcoin affordable for almost anyone.

The Sign Up Process

Step 1

Create a River Account by clicking the button below:

Step 2

Add your email, phone and address and then verify the information by receiving an email and text message.

Step 3

Add your payment method. You can skip this part until you're ready.

Step 4

Buy Bitcoin. Start investing. Alternatively, you can utilizing the Bitcoin Basics training in the River learning center.

Be sure to watch Rugpull Radio for continuing Bitcoin education. Every Thursday at 10:30pm EST. Only on Badlands Media.

Notice: River and/or Badlands Media does not provide investment, financial, tax, or legal advice. The information provided is general and illustrative in nature and therefore is not intended to provide, and should not be relied on for, tax advice. We encourage you to consult the appropriate tax professional to understand your personal tax circumstances.